我们专注于建筑板材生产,打造成华南颇具实力的板材企业

大投入

公司成立与2011年,一期投入1.8亿元大规模

公司地处佛山市高明区,占地面积达200多亩实力背景

开云|官方下载-手机版Download与广东弘城集团共同投资开云|官方下载-手机版Download环保板材优越特性

100%零石棉

真正的100%零石棉,产品和生产车间中不含对人体有害的石棉纤维。

防火性优

硅酸钙板是不燃A级材料,万一发生火灾,板材也不会燃烧,不会产生有毒烟雾。

强度高

硅酸钙板是不燃A级材料,万一发生火灾,板材也不会燃烧,不会产生有毒烟雾。

防水防潮性优

硅酸钙板有极好的防潮性能,在卫生间、浴室等潮湿环境下,仍能保持性能稳定,不会发生膨胀或变形。这些地方都使用

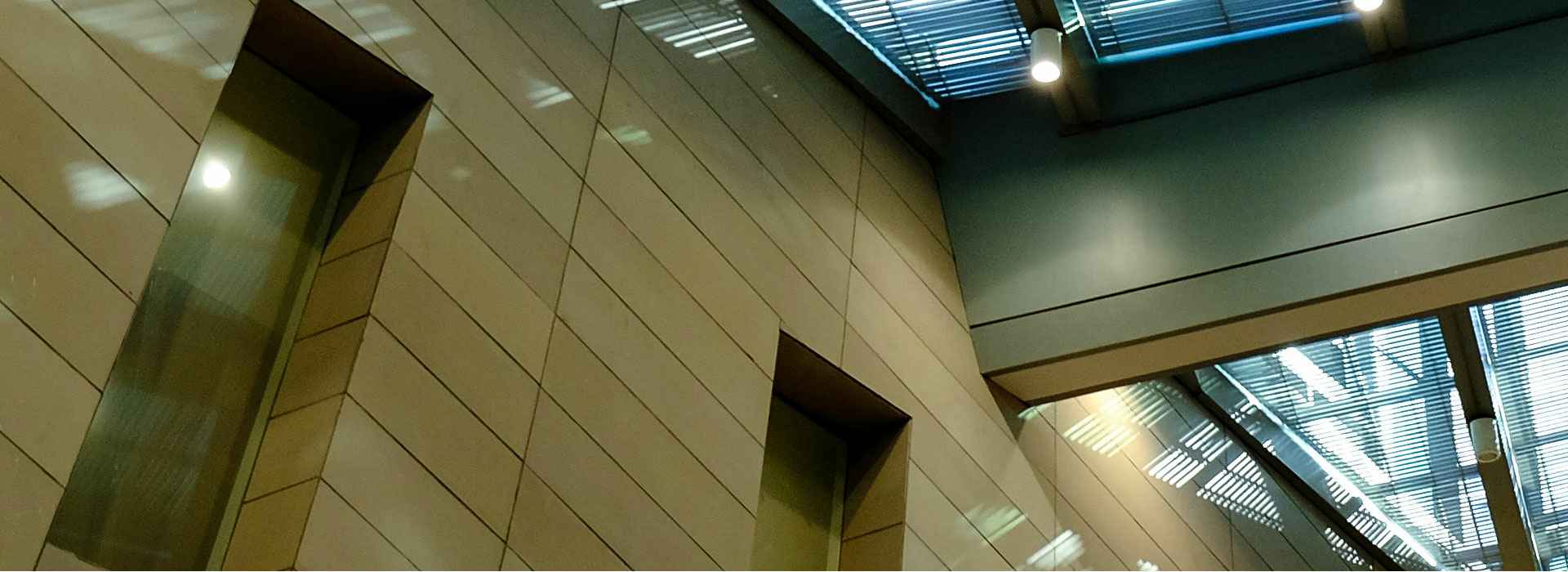

顺德喜来登酒店

顺德喜来登酒坐落在广东省顺德区大良新城区德胜中路11号 ,客房面朝天然公园和美丽的江景。顺德喜来登酒店距零售商场、表演艺术中心、科技馆、公园和政府大厦均只有10分钟车程,可方便驶入链接珠三角地区主要城市(香港、澳门、广州和深圳)的高速公路。

顺德喜来登酒店

顺德喜来登酒坐落在广东省顺德区大良新城区德胜中路11号 ,客房面朝天然公园和美丽的江景。顺德喜来登酒店距零售商场、表演艺术中心、科技馆、公园和政府大厦均只有10分钟车程,可方便驶入链接珠三角地区主要城市(香港、澳门、广州和深圳)的高速公路。

顺德喜来登酒店

顺德喜来登酒坐落在广东省顺德区大良新城区德胜中路11号 ,客房面朝天然公园和美丽的江景。顺德喜来登酒店距零售商场、表演艺术中心、科技馆、公园和政府大厦均只有10分钟车程,可方便驶入链接珠三角地区主要城市(香港、澳门、广州和深圳)的高速公路。

顺德喜来登酒店

顺德喜来登酒坐落在广东省顺德区大良新城区德胜中路11号 ,客房面朝天然公园和美丽的江景。顺德喜来登酒店距零售商场、表演艺术中心、科技馆、公园和政府大厦均只有10分钟车程,可方便驶入链接珠三角地区主要城市(香港、澳门、广州和深圳)的高速公路。

顺德喜来登酒店

顺德喜来登酒坐落在广东省顺德区大良新城区德胜中路11号 ,客房面朝天然公园和美丽的江景。顺德喜来登酒店距零售商场、表演艺术中心、科技馆、公园和政府大厦均只有10分钟车程,可方便驶入链接珠三角地区主要城市(香港、澳门、广州和深圳)的高速公路。

顺德喜来登酒店

顺德喜来登酒坐落在广东省顺德区大良新城区德胜中路11号 ,客房面朝天然公园和美丽的江景。顺德喜来登酒店距零售商场、表演艺术中心、科技馆、公园和政府大厦均只有10分钟车程,可方便驶入链接珠三角地区主要城市(香港、澳门、广州和深圳)的高速公路。

前 台:

传 真:

地 址:

Copyright 2019 开云|官方下载-手机版Download 版权所有